LAWMAKERS TACKLE TINUBU’S ECONOMIC TEAM OVER 2025 BUDGET PLAN

The National Assembly has taken President Bola Tinubu’s Economic Team to task over the proposed 2025 budget, citing concerns over the disproportionate allocation of funds towards recurrent expenditure.

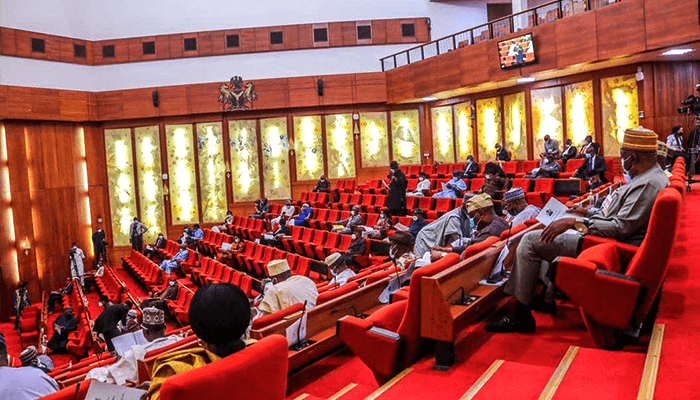

During an interactive session on Wednesday, lawmakers from the joint Appropriation committees of the Senate and the House of Representatives grilled the Economic Team, led by Minister of Finance Wale Edun, over the bloated recurrent expenditure in the N49.7 trillion 2025 budget proposal.

The lawmakers expressed dismay over the huge discrepancies in the amount of recurrent expenditure, which they argued comes at the expense of capital expenditure. They also noted the low fund releases for capital projects in the 2024 budget, which will run until June 30, 2025.

The National Assembly team, led by Senator Olamilekan Solomon Adeola and Rep Abubakar Bichi, urged the Executive arm to ensure the release of adequate funds for capital projects in the 2024 budget. They argued that this is essential to serve Nigerians and make them feel the impact of the administration’s economic policies.

The lawmakers pointed out that the huge recurrent expenditure only benefits a negligible segment of the population.

A statement issued on Wednesday night by the Media Adviser to the chairman of the Senate Appropriation Committee, Kayode Odunaro, said the report of the Presidential Economic Team showed that the 2024 budget performance was just 43 percent, with recurrent expenditure achieving 100 percent while capital expenditure was only 25 percent.

Chairman of the Senate Appropriation Committee, Senator Solomon, emphasized the need to drastically reduce the wide gap between recurrent expenditure and capital releases in budget cycles. He noted that capital releases to Ministries, Departments, and Agencies (MDAs) are the major drivers of economic activities within the nation.

Meanwhile, Rep Abubakar Bichi, chairman of the House of Representatives Appropriation Committee, called for more releases for capital projects, such as schools, roads, dams, hospitals, and other social infrastructure. He argued that debt repayment, which can be restructured, should not take precedence over these critical projects.

“Most of the items of recurrent expenditure which takes a huge part of our budget and is implemented 100 per cent will only directly affect about 10 per cent of our population while capital projects of the MDAs will directly affect majority of over 200 million Nigerians in areas of social infrastructure provisions like hospitals, schools, roads and energy,” Bichi said.

The Minister of Finance, Wale Edun, confirmed the outstanding capital releases, blaming the non-availability of funds for the lapses. Meanwhile, the Minister of Budget and National Planning, Senator Abubakar Atiku Bagudu, attributed the huge recurrent expenditure to the nation’s low level of development and challenges confronting the nation, including spendings on insecurity.

The Director General of the Budget Office, Dr. Tanimu Yakubu, also attributed the huge recurrent expenditure to past legacies inherited by President Bola Tinubu, including unpaid pensions and gratuities. He suggested legislation aimed at limiting recurrent expenditure in future budget cycles.