WHY NIGERIANS ARE GETTING POORER, BY DELE SOBOWA LE

“Behind the facts of economics are the facts of psychology… The emotions of fear and confidence, the judgments of doubts and certainty constitute a very important medium through which we see economic values” – Arthur S Dewing, Harvard Business Review, 1923.

WHY NIGERIAN BUDGETS OFTEN FAIL

“Whatever a man prays for, he prays for a miracle; every prayer reduces itself to this; Great God, grant that twice two be not four” – Ivan Turgenev, 1818-1883, VANGUARD BOOK OF QUOTATIONS, VBQ, p 198.

Experiential Learning: Building the Wealth of The Nation

No federal or, as far as I know, state budget since 1999 has been successfully implemented as written by the president or governors and approved by the lawmakers in Abuja and the states – for one cardinal reason. Almost invariably, they are at best prayers by the Chief Executive Officers (CEOs), rubber-stamped by the legislative branch; and nobody monitors execution from the start to the finish.

Occasionally, the CEO returns to request for supplementary budget approval; receives it without anybody among legislators asking questions about projects which were slated for the year.

The over 70,000 abandoned projects littering Nigeria, representing monumental waste of public funds are emblematic of the failure of democracy in Nigeria. Neither the executive nor the legislative branches had served the people well.

Annual budgets often fail because they constitute more of political gamesmanship than economic plans. To begin with, under civilian governments, since 1999, no budget presentation had started with a review of the current year’s performance.

Yet, every adult should know that the present situation is a result of choices made in the past; and it will influence the possibilities available tomorrow. Having failed to deliver on most of their promises, the CEOs ignore the results; present a new year’s budget as if the nation or state is starting on a clean slate without a lot of baggage from the past.

Nobody needs to be an economist to realise that this is self-deception.

RECURRENT FAILURE OF BUDGETS SINCE 1999

Insanity has been defined as doing the same thing over again and expecting a different result.

After Obasanjo’s first two years in office, no Nigerian president should have got into the trap of treating the annual budget as a political document; instead of a framework for economic development and social advancement.

That sense of responsibility would always dictate that the framers of the budget be as truthful as possible in their projections.

Furthermore, they should always admit it when they fail and set about finding out the reasons for failure. The lessons learnt would help subsequently to achieve better results.

Two examples of wishful thinking pervading budgeting at the federal level will help to illustrate the point.

Every budget, since 2009, had been based on the assumption of 2.3 million barrels per day, mbpd, of crude oil produced and exported.

Yet, records easily available to governments since then would prove beyond reasonable doubt that Nigeria has been producing, for export, approximately 1.4mbpd virtually every year.

The records for 2022, 2023 and now 2024 have not altered the pattern.

Yet, despite the overwhelming evidence, the budget for each year had been based on 2.3mbpd. Consequently, the budget each and every year was based on predictable negative dollar revenue variance – which would later result in three other shortfalls. One, lower than expected dollar supply will impact exchange rate negatively; the naira will depreciate further. Two, budgeted aggregate deficit will be exceeded. Aggregate revenue would fall below expectations; unless the currency is devalued and inflation rate increases.

The Nigerian economy has been suffering from all these budgetary miscalculations for 25 years; and we are about to enter a new year without altering our approach to budgeting.

Who, for instance, believes that exchange rate will decline to N1400/$; or that inflation will come down to 15.8 per cent – when at the end of November, we are experiencing N1690/1740/$ exchange rate and inflation now racing towards 33.50 per cent?

Commonsense, which obviously is not common among our political leaders, would indicate that the starting point of a good budget is to ask and answer the following questions: Where were we before? Where do we stand now? How did we get here? Where would the next budget take us as presented? Is this where we should be? If not, what must we do differently to improve on performance in the coming year?

BUDGETS 2022-2025: COMPARATIVE SUMMRY

“A picture is worth a thousand words”, we have been told.

A table can sometimes be worth more than ten thousand words.

That is the reason for leading off with the table. More analysis will follow.

The table below helps Nigerian to quickly understand the trend for four years.

WHY NIGERIANS ARE GETTING POORER

BUDGETS 2022 – 2025

Year Budget #Tn Exchange Rate Budget $bn

2022 17.13 #420 / $ 41.76

- 2023 21.83 #434 / $ 50.11

2024 28.78 #800 / $ 35.97

2025 47.90 #1400/ $ 34.14

- The 2023 Budget was the most dishonest in history.

By November 2022, the exchange rate at the parallel market was already close to #700 / $.

Nigeria was heading for economic decline when global crude oil prices tumbled from over $120 per barrel during Yar’Adua/Jonathan administrations.

Our stubborn refusal to diversify the economy, insist on adequate power supply, promote agriculture and agro-allied industries, scrap the unproductive four refineries and deregulate the petroleum sector – until too late – have left us with a fragile manufacturing sector.

By 2014, crude oil price had fallen to under $80; by the time Buhari took over in 2015, it was less than $60. Furthermore, production had gone from 1.7mbpd to under 1.5mbpd.

The cumulative impacts of low crude prices and low output led to the recession of 2016; from which the nation has not recovered.

On the contrary, the situation has become worse. President Bola Tinubu might not realise it, but, the proposed budget for 2025 indicates that, even at N1400/$, recovery is not in sight; at N1690/$ the expectation drops to $28.40bn.

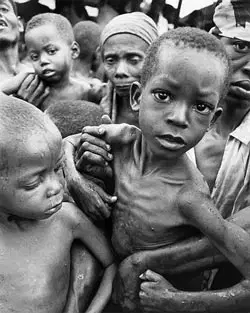

POPULATION AS A FACTOR IN POVERTY ALLEVIATION

Nigeria is one nation which has defied the Malthusian theory regarding the relationship between population and food production.

Perhaps population decline will come later.

But, working within shouting distance of a Children’s Hospital would suggest that the noticeable decline in food production in the last two years had no impact on child birth.

All the new baby cots are still occupied – with some sleeping on blankets on the floor.

The outlook gets more depressing if population growth, 6 million additional Nigerians, and higher inflation are factored into the consideration. Population growth will certainly reduce per capita GDP – with grave implications for investments. Nigeria, once regarded as a country with great market potential, is being gradually downgraded.

The 2025 Budget is unlikely to change the outlook.

Furthermore, there is a direct linkage between economic growth, population growth and poverty levels.

Since 2014, Nigeria’s Gross Domestic Product, GDP, has not in any year exceeded its population growth despite budgetary projections.

The 2025 Budget, like all the others before it, assumes 4.6 per cent growth for the year.

Given all the obvious in-built negative variances likely to occur in aggregate revenue, exchange rate expectations, debt servicing, and foreign direct investments, among others, few economic and financial analysts believe that the target will be achieved.

This brings us back to Dewing’s observations about “emotions of fear and confidence, the judgments of doubt and certainty”.

For any economy to achieve over 4 per cent GDP growth in any year, its manufacturing sector must be convinced by the government.

Right now, Nigeria’s manufacturers remain sceptical. Here is why.

PROSPECTS FOR MANUFACTURING SECTOR

“An economy can only be as strong as its manufacturing base” – Akio Morita, Harvard Business Review, May-June, 1992.

While the Minister of Finance and Coordinating Minister, Wale Edun, expectedly claims that the nation’s macroeconomic environment is now stable, the Manufacturers’ Association of Nigeria, MAN has a different view.

According to Segun Ajayi-Kadir, the Director General of MAN, “It is evident that the expected relief from the negative impacts of the reform is yet to fully kick in. We are already seeing an escalation of those factors as the floating of the exchange rate has not brought the expected stability, petroleum products costs are rising and inflation remains stubborn despite increasing interest rates.”

Given the divergence of views between the FG and manufacturers, it is obvious that the private sector will act based on its fears and doubts.

They (manufacturers) have a major reason to be apprehensive.

Unsold finished goods are piling up everywhere. Some companies are sitting on four to six months stock of goods with expiry dates drawing near. Manufacturing has crawled almost to a stop.

Many will not start 2025 in a bullish mood.

Paradoxically, the increasing price of products reduces aggregate demand; that curtails production and raises cost of production – leading to another round of price increase.

Coca-cola, which, in January, retailed for N250 is now N500 or more.

It is not clear if the elasticity of demand will not eventually result in total collapse of some brands and the companies marketing them.

PETROLEUM AND FOREX: THE TWO ELEPHANTS IN THE ROOM

“You can get in more trouble with good ideas than bad ones; it is so much easier to push a good idea to excess” – Ben Graham, VBQ p 97.

Two good ideas got us into more trouble than before – fuel subsidy removal and floating exchange rate. Tinubu committed a great blunder by acting too prematurely on the two issues.

Because, in every corrupt country, any attempt to wipe out corruption is an affront to those who benefit from the corruption, the new president should have first investigated and found out, who were the beneficiaries of fuel subsidy payments as well as favourable exchange rate allocations from the Central Bank of Nigeria; and how much each of the economic parasites had swallowed.

Then, he would have known those likely to sabotage his reform.

Nigeria’s four refineries did not all pack up because they were beyond repairs.

Saboteurs wrecked them in order to import fuel. Similarly, crude oil theft was not just a matter for small time crooks stealing crude for their crude refineries.

A former governor of an oil producing state, of the 1999-2007 class, suspecting foul play, hired international detectives to monitor crude shipments from his state.

He discovered that more crude was being shipped from Nigeria than the quantities delivered in Europe. He reported his findings to the appropriate authorities. The response was a death threat – if he did not mind his business!!!

Tinubu erred by not first identifying his real opponents in this contest of wills.

That was the major cause of the failure of his reform agenda so far.

Unless the FG steps backwards and find out who were the major beneficiaries of fuel and foreign exchange corruption, he will continue to labour in vain.

There are still serious doubts about the basic assumption in the budget.

Even if Nigeria can produce 2mbpd of crude per day from January next year, it is unlikely that the global demand will be there.

Again, several unavoidable facts dictate caution.

One, the GDP growth of the two largest economies – USA and China – is expected to slow down and reduce global demand for oil.

Two, all the car and truck manufacturing nations are driving furiously away from fossil fuel.

Acceleration of the transformation to renewable energy sources – solar, hydrogen, wind, ammonia – is certain based on the investments and national positions being taken now.

Even Saudi Arabia, the world’s largest oil exporter, is now investing massively in hydrogen plants.

Three, the Organisation of Petroleum Exporting Countries, OPEC, is no longer the dominant power block in global crude trade.

More countries have discovered oil and want to supply what is left of a shrinking market.

Nigeria’s current quota is 1.7mbpd; it is unlikely that OPEC will increase the quota with the possibility of oil glut in view.

Anyway you look at it, the budget, based on shaky crude oil production and export foundations, is on very slippery grounds.

WHAT CAN NIGERIANS REASONABLY EXPECT?

“A salad bowl of illusions”, that was how George Santayana, 1863-1952, American philosopher and poet, described certain government proposals which he knew would never yield the desired results.

Annual budgets by Nigerian governments have become a ritual presentation of the same bowls of stale salad which even the framers know will never be implemented.

This is another one.

Like all the previous budgets, the 2025 Budget will start generating negative variances from January 1; and it will never be implemented.

For the first time, nobody is claiming that the budget is good, the only problem is implementation. Even the Yes-men of governments are tired of failed budgets.